U.K. threatened to quit the Brexit talks, while the Conservatives’ opinion poll lead dropped. What does it all mean for the gold market?

We have understandably focused on political turmoil in Washington recently, but the situation in London has also become more complicated. First, the Brexit Secretary David Davis has told Sunday Times that the U.K. will walk away from Brexit talks unless Brussels drops demands to charge it €100 billion to leave the EU. These remarks triggered some worries about the possibility of a hard Brexit. Such a scenario could be quite chaotic, which should be positive for the gold market.

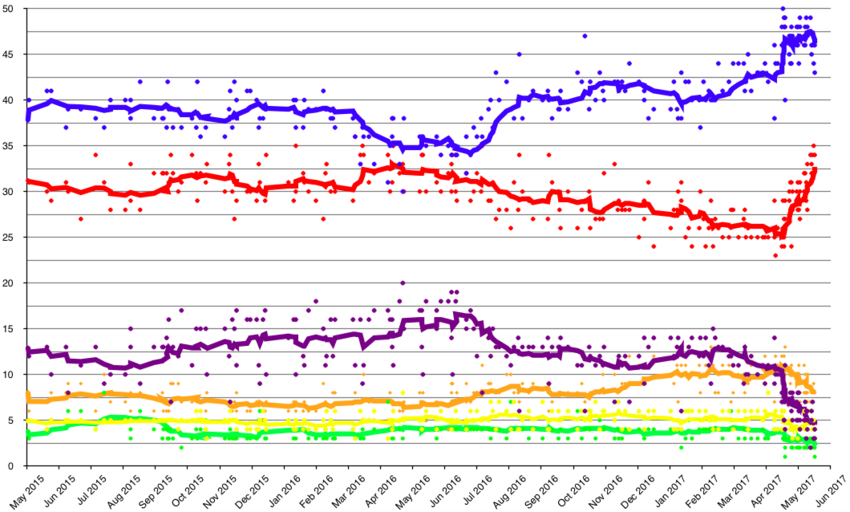

Second, on Thursday, May declared that some elderly people should pay a greater share of their social care costs. It may make economic sense, but voters did not like the idea. The Tories’s lead dropped significantly in just a few days, as one can see in the chart below.

Chart 1: Opinion polls for 2017 British general election (moving average is calculated from the last ten polls).

Actually, the chart above shows moving averages for the last ten polls, so it overestimates the Conservative Party’s lead. According to Reuters, six recent opinion polls have all shown the narrowing of lead by between 2 and 9 percentage points.

Although May’s party is still likely to win the elections, she was forced to backtrack on her election pledge about social care of the elderly. There are still more than two week left before the elections, so the race may tighten up further. The more uncertain the outcome is, the better for safe-havens like gold, especially now when political risks seem to outweigh market fundamentals for the yellow metal.

However, investors should not overestimate the impact of the British election. Tories are still set to win, so little will change after June 8. The hard version of Brexit would be a more significant event for the gold market, but it’s still too early to announce the shape Brexit will take. A hard Brexit does not seem to be the optimal scenario, but politicians are guided by electoral gambits rather than rational calculation.

And yesterday’s Manchester attack during Grande’s concert in which more than twenty people died added even more challenges for the U.K. Gold gained initially in reaction to the blast, but the move up was erased during Asian trading hours – the attack is unlikely to have a lasting impact on the gold market. Instead, gold should remain much more sensitive to the uncertainty surrounding Donald Trump’s presidency and the Fed’s actions – as a reminder, the minutes of the FOMC previous meeting is due out this week. Stay tuned!

If you enjoyed the above analysis, we invite you to check out our other services. We focus on fundamental analysis in our monthly Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you’re not ready to subscribe yet and are not on our mailing list yet, we urge you to join our gold newsletter today. It’s free and if you don’t like it, you can easily unsubscribe.

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview