Breakdown (a.k.a. Support Line Breach) and Role Reversal

If a support line is penetrated by a significant amount, or the price stays below this line for a prolonged period of time, we can speak of a breakdown. The support line becomes a resistance line, i.e. a line off which the price is more likely to bounce than to cross it from below – it is a concept contrary to the one of support. The same psychological factors (such as grief and regret) as in the formation of support play an important role in this case. An example of a support line becoming a resistance line is shown below.

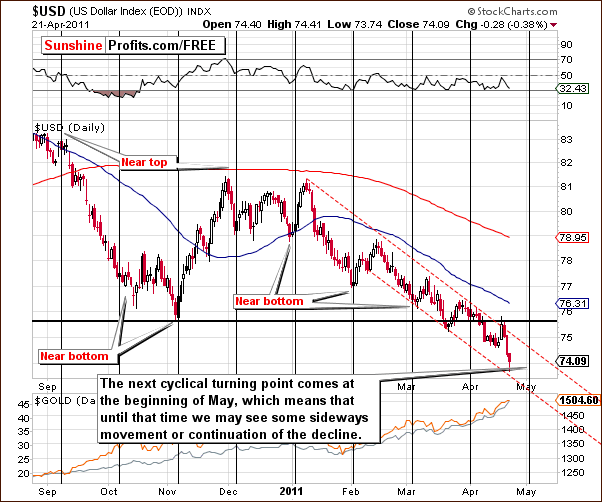

The November 2010 bottom provided support for the U.S. dollar in March 2011. The support was tested but the dollar initially reversed to the upside. Following that, in April 2011 the dollar broke below the support. The breakdown was tested but the currency subsequently verified it and went even lower, toward the 74 level.

Verification of a Breakdown

In order to consider a violation of a support line valid, at least one of the criteria listed below should be met:

- The move below the support line should be significant. There is no clear rule telling what constitutes a significant move. Some use 3% as a benchmark in the case of important support levels and 1 % for the short-term ones.

- It should be accompanied by high volume.

- Price should close below the support level for 3 constructive trading days to confirm the breakout .

Conclusion

The idea of a breakdown is a fundamental one in technical analysis. It can be very useful in making investment decisions as it allows a trader or an investor to take advantage of certain market moves.

If you’d like to learn more about gold, breakdowns in gold and, in particular, about its most recent price swings and their implications (What is currently the nearest important support in gold?), we invite you to sign up for our gold newsletter. It’s free and if you don’t like it, you can easily unsubscribe. Sign up today.