Bernanke and Gold

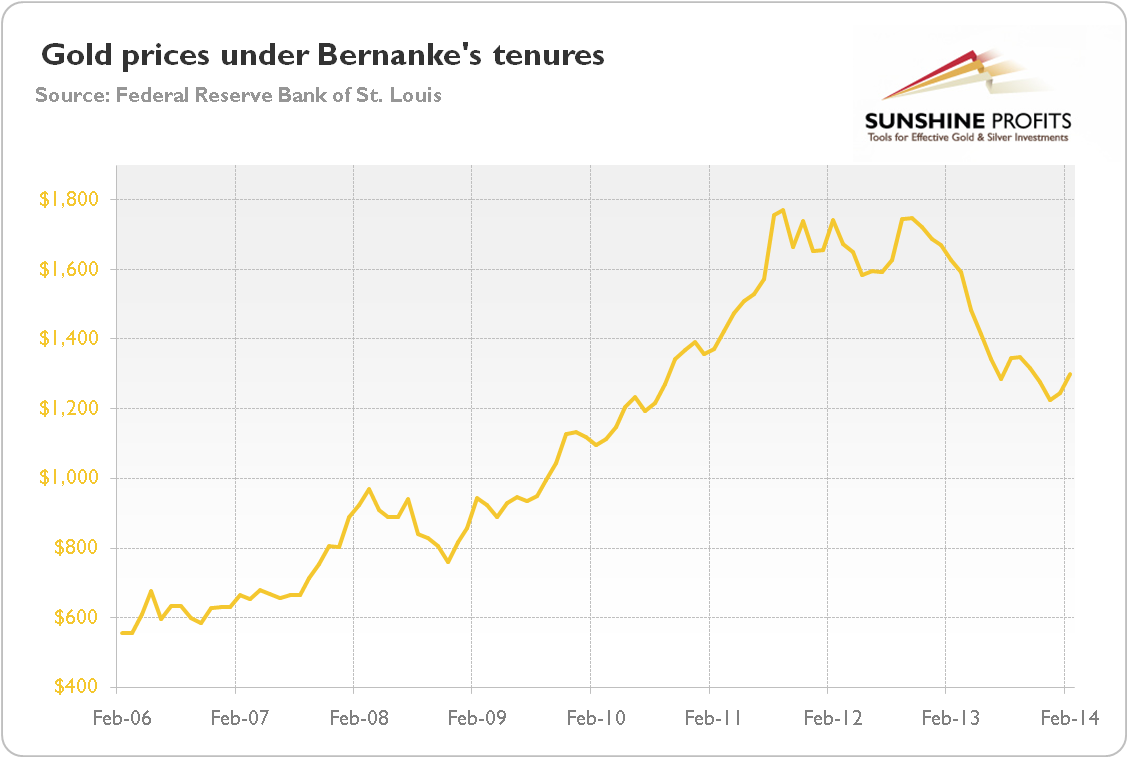

What was the Bernanke’s impact on gold? Well, it was quite positive, as gold gained about 134 percent under his tenure, as one can see in the chart below.

Chart 1: Gold prices (London P.M. Fix, in $, monthly averages) under Bernanke’s Fed tenure.

What were the reasons behind such a rise? Well, in 2008 the Lehman Brothers collapsed, triggering the financial crisis. The price of gold initially declined, as investors liquidated their gold holdings to raise some cash. However, after a while, gold started to soar due to the increased safe-haven demand.

Bernanke helped to ignite the rally in gold, as he conducted unconventional monetary policy as a response to the crisis. In particular, he implemented ZIRP by slashing the federal funds rate to practically zero. Since it didn’t help to stimulate economy, Bernanke inaugurated the quantitative easing, ballooning the Fed’s balance sheet.

The first two rounds of these asset purchases programs were very positive for the precious metals market, as investors worried about the rise in the money supply and inflation. The price of gold almost reached $1,900. However, as the U.S. economy recovered and there was no inflation on the horizon, the price of gold entered a bear market in September 2011, just two months after the end of the QE2. The increased confidence in the Fed and the U.S. economy reduced risk premium and the bidding for tail risk insurance. Consequently, the stock market rose, while the price of gold declined.

We encourage you to learn more about the gold market – not only about the link between Ben Bernanke and the yellow metal, but also how to successfully use gold as an investment and how to profitably trade it. Great way to start is to sign up for our gold newsletter today. It’s free and if you don’t like it, you can easily unsubscribe.