A couple of weeks ago, Kellie Ell of CNBC reported, The tech sector now is reminiscent of the 1990s dotcom bubble:

Warning signs in today’s tech sector are reminiscent of the dotcom boom of the late 1990s that eventually went bust, market veteran Jim Paulsen told CNBC on Friday.

The current “character and attitude of the marketplace” are similar to the belief then that “tech can’t lose,” said the chief investment strategist at The Leuthold Group.

“What I find interesting, is that there’s been significant narrowing of participation in the S&P 500 as these FANG stocks have really taken over,” Paulsen said on “Squawk on the Street.”In 2013, Jim Cramer, host of CNBC’s “Mad Money,” popularized the term FANG, which stands for shares of Facebook, Amazon, Netflix, and Google, now part of Alphabet. More recently, another “A” was added to FAANG, representing Apple, and there’s been talk about how to incorporate an “M” for Microsoft.

Excluding tech stocks, the rest of the S&P has consistently, since 2013, been underperforming, compared with the overall market, Paulsen said.

“You could argue the contemporary fascination with technology stocks has just completed an entire dotcom cycle,” Paulsen wrote in a note to clients. “That is, for five years, tech has dominated the S&P marketplace which is surprisingly close to how long tech dominated during the dotcom run in the 1990s.”

“I just wonder if it might end similarly,” Paulsen told CNBC Friday. “Not to the same magnitude, but similarly.”The “dotcom bubble” from about 1995 to 2000, was a time of rapid growth in the equity market fueled by internet company investments. The bottom fell out in March 2000, which saw the Nasdaq, a index of with lots of tech stocks, lose nearly 80 percent of its value by October 2002.

Larry Haverty, managing director at LIH Investment Advisors, said there are “a lot of warning signs” in the market right now, such as increased regulatory scrutiny in the tech sector.

“Eventually the law of large numbers is going to get [the FANG stocks],” Haverty said on “Squawk on the Street.” “With Amazon, I think the demon is antitrust.”

But Paulsen pointed out a clear distinction between today’s technology sector and the 1990s is the Russell 2000. Within the small-cap index, he said, tech stocks are matching overall market performance, “rather than significantly outperforming it.”

He added, “Unlike the dotcom in the late 90s, where both small-cap and large-cap stocks were far outperforming the average stock, that’s not happening in the small cap universe.”If investors want to maintain a technology weight in their portfolios, Paulsen said, “Do it in small- and mid-cap stocks as opposed to the popular FAANG names.”

This week, Stephanie Landsman of CNBC followed up, A dangerous dot-com era phenomenon is back and it’s going to inflict pain, market watcher Jim Paulsen warns:

A new research note warns that too many investors are stuck in a losing trade reminiscent of the dot-com era.

The Leuthold Group’s Jim Paulsen is behind the ominous call.

“More and more of the leadership stocks have been the more aggressive, high beta stocks and a lot of the defensive names have been left for dead. They’ve diminished as far as their size of the overall [S&P 500] index,” the firm’s chief investment strategist said Monday on CNBC’s “Trading Nation.”

Paulsen hasn’t seen that phenomenon since the late 1990s when excitement surrounding dot-com stocks hit a fever pitch.

“I don’t think it is nearly as severe as it was back then, but the culture is the same. The character is the same where everyone is going into the same, very narrow number of popular names,” he said. “Really nobody is investing new moneys into the rest of the S&P.”He included a chart that shows a sharp decline in the number of people investing in S&P 500 defensive names since the bull market began in 2009 — noting that defensiveness is at a record low.

According to Paulsen, many investors are too exposed to trendy areas of the market such as big tech FANG, otherwise known as Facebook, Amazon, Netflix and Google parent Alphabet.

“You wonder if we do hit an air pocket, if we would break below those February lows sometime this year, who do you think is going to sell? It’s probably going to be those popular names because that’s all anyone has recently bought,” he said.

Paulsen, who estimates there’s a 50-50 chance see a 15 percent sell-off this year, is urging investors who are overweight big tech to take some profits.

“Maybe to pat yourself on the back, congratulate yourself for a great investment,” Paulsen said. “Maybe buy a beat-up consumer staple or utility here or pharma stock today that no one is taking a look at, but sells at a much better value.”

It’s Friday, tech stocks have been on a tear since I wrote my comment back in February explaining why I thought it was another correction, not something worse.

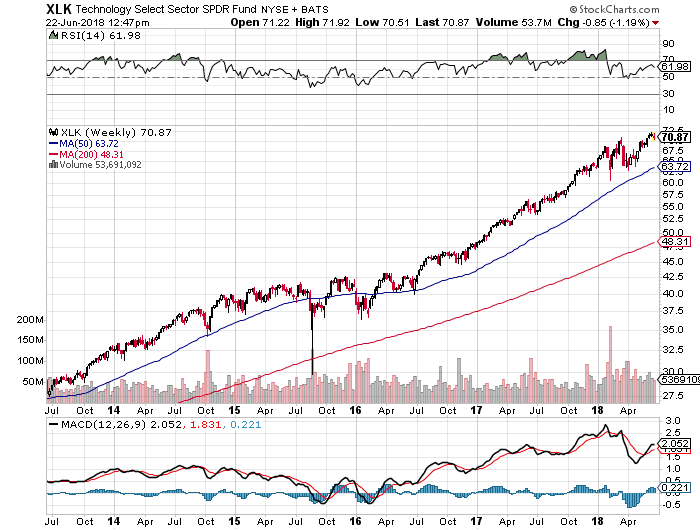

Have a look at the daily and weekly chart of the S&P Technology ETF

What do these charts tell me? They tell me that in the short run, there may be a pause in this tech rally but that’s not a given because the longer-term monster move is still there, making new highs on the weekly and monthly charts. Why are tech stocks on fire? There definitely are many crowded trades in the tech space as big hedge funds with billions under management are looking to buy the same big tech names.

Just go look at what top funds were buying last quarter to get a sense of how most of the big funds all clamored into big tech stocks during the sell-off in Q1. Facebook

Just look at the 5-year weekly chart of Netflix

So what else is driving this renewed mania for technology stocks? Well, for one thing, earnings. Big tech stocks might have a high P/E but unlike the 1999 hope & hype, they’re producing billions in earnings and literally look unstoppable, much like the US economy.

In fact, in his latest weekly comment, Trade Wars Means Fed Overkill, David Abramson of Alpine Macro notes the following on why a tech mania may be emerging:

Technology stocks have gone vertical both in absolute terms and relative to the broad market. Our view has been that this trend will lead to a rotation as other market leaders, such as energy, financials and global growth plays, emerge. Meanwhile, interest-rate sensitive defensive sectors like consumer staples, utilities, REITs and telecoms are overdue for a bounce.

This rotation makes sense, given relative valuations and our expectations of a bull market in commodities. However, the timing is far from clear. The odds are rising that a technology mania will develop on the order of the late 1990s bubble.

You will need to read David’s fascinating comment at Alpine Macro (contact [email protected]) to get the details but he basically goes over why even though the tech sector is vulnerable to a correction, the long-term rally isn’t over yet.

But there is another reason why many portfolio managers are buying large-cap tech stocks here, they’re a defensive play on a slowing economy. In his interview with Consuelo Mack of WealthTrack, top-ranked portfolio strategist François Trahan of Cornerstone Macro explained the changing market leadership and why it’s predictable.

What François told me is we’re at an inflection point where leading economic indicators have peaked, the US economy is slowing but it’s still doing well, so portfolio managers see large-cap tech shares as part of a Risk-Off trade (go see my Outlook 2018: Return to Stability for why large-cap tech is a defensive play initially when leading indicators peak).

Will this tech rally last forever? Of course not, but it could last a lot longer than what we think. One thing François told me: “It will end badly and that’s when defensive sectors and US government bonds will do well.”

What if you don’t like high-flying tech shares like Netflix? No problem, use the weakness in consumer staple shares

Since the begining of the year, I’ve been recommending more stable sectors like healthcare

We’ll see what happens, there might be another tech mania on its way driven by quant hedge funds and passive index funds but it’s too soon to tell whether we’re there yet.

I remember 1999-2000 like it was yesterday. I also remember 2008 like it was yesterday. Some things you never forget. This isn’t 1999-2000 or 2008, at least not yet.

And while everyone is impressed with Netflix, check out the performance of some of these small biotech

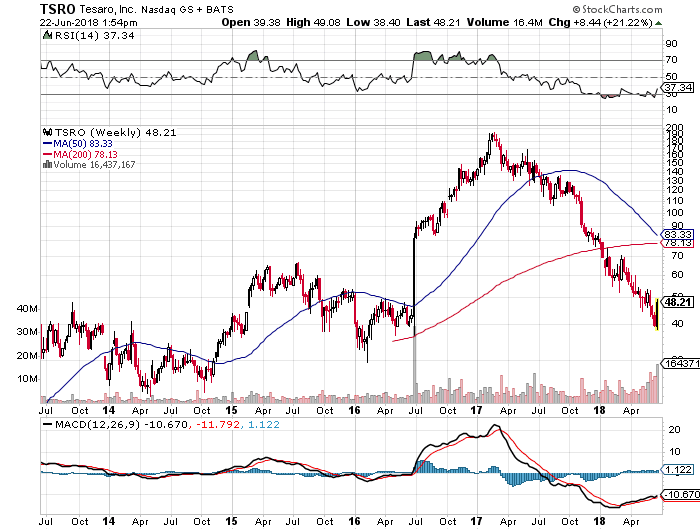

Now, if only someone can tell me whether shares of Tesaro

That’s why they say “biotech is BINARY”! Don’t chase these or any of the stocks mentioned in this post. I’m just trying to show you there’s a lot more to this market than large-cap tech stocks.

Below, some stocks moving up on my watch list Friday afternoon (click on image):

And no, they’re not just biotech stocks even though that is my primary focus. Again, don’t chase these or any stocks, especially if you don’t know what you’re doing, you will get burned alive.

I can say the same for all those young Canadians buying pot stocks for their TFSA portfolios, the funny thing with momentum, it works well on the way up but when the floor gives out, OUCH!!

But nobody seems to care, lots of people are getting high on pot stocks. Enjoy your buzz brothers!

As for the rest of you, you can play momentum, chasing large-cap tech stocks along with those big quant funds taking over the world, just be careful, when the music stops, it’s going to be brutal and you’re going to wish you bought some Kraft-Heinz (KHC), Campbell Soup (CPB) or Procter & Gamble (PG) or good old US long bonds