Last week, in Part 1 of our conversation with Kristin Hull, she shared her origin story and told us about the work that Nia Impact Capital does. Today, in Part 2, we dive in deeper and explore some of the challenges that women in finance face to this day—but also celebrate the wins that Kristin’s team has achieved.

Birgitte Rasine: What makes Nia unique in the world of finance in general and impact investment in particular?

Kristin Hull: We’re women-led, so that makes us very, very, very unique. We’re in that 0.7% … less than 1%. We’re unique by having a woman founder and also by having women portfolio managers and women in leadership. One of our portfolio managers is a black man, so that also makes us unique, to have people of color in leadership and asset management. So just who we are, makes us unique.

Then there’s the fact that we’re not doing finance as usual. I believe we’re one of the only firms out there that understands that finance is a really strong tool and that we can harness it for social gains, social justice gains and environmental sustainability. And then we want to empower our clients. A lot of asset management firms want to serve their clients, and yet the knowledge stays at the firm and [doesn’t get transferred] to the clients. We really want our clients empowered. So that makes us a little bit different.

And then, as far as public equities are concerned, we do seek to be in relationship with every one of our companies, so we reach out and engage as often as we can to help these companies be better.

BR: What would you say has been your toughest challenge in doing this work?

KH: Oh, my [laughs]. Our toughest challenge… it happens every day. You know, we are women in asset management, and we are in an incumbent economy. So it’s on daily! The patriarchy is alive and well; the status quo is pretty strong. Navigating our way through that is intense.

BR: Do you feel that on your personal level, or do you think your entire team feels that?

KH: That’s a good question. I am probably the most outward facing. Anybody who deals with the big banks, you know, the Schwabs, the Fidelitys, is used to getting a ‘no.’ So we’ve got to hang in there and work towards a ‘yes,’ or find another way to do it. Who can we go around, who can we bring into the conversation, for whatever it is we need? Yeah, I think I probably feel it the most.

BR: In your field, the field of finance and investment, what specifically makes you have to fight all that much harder?

KH: There’s a woman that I know named Samantha—actually I know a few people named Samantha who go by Sam, who very specifically sign their communications ‘Sam’ and they get more meetings. They don’t get blocked from the meetings. I don’t know that our business would be that much more successful if I signed my name Chris, but it’s very tangible—the male female difference, the bias against women in the space, that is for sure.

And then there’s the fact I’m trying to do not just regular asset management. I’m trying to challenge what has worked for the dominant culture for so long, or for the very few. We’re bringing in a gender lens. We are looking at every lever we can pull for racial equity in asset management. We want our companies to be the very best on environmental sustainability. We do believe that that is a winning business model. And we’re not asking them to do anything that would inhibit them receiving more return on investment, having a stronger brand—all those things. There are multiple layers to what we’re trying to do and we’re in a minority position trying to do it.

BR: What will it take for women to succeed? Is it simply more companies like Nia or is there more to it—because, as we all know, a woman has two problems in the office. One is the patriarchy and the second is other women who might be trying to keep her down.

KH: Oh, absolutely. There’s no mean girl culture at Nia—we support each other for each other.

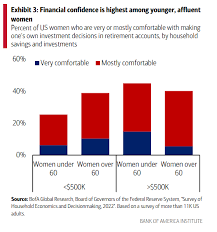

Part of the patriarchy is that we feel separated and a lot of women feel alone. They feel that they’re the only ones that don’t know how to do their investing. And yet, you know, very few of us were taught this in college, and certainly not in high school. A lot of this you learn at the dinner table or in some kind of group setting. It’s not something you learn alone. So if you weren’t included in that conversation, the patriarchy places this layer of shame on you, because you don’t know it.

We’re trying to break that layer down, and provide education and make sure everyone knows that we’re in this together. We’re also trying to create the most transparent, easy-to-understand portfolios and talk people through them—and then of course our activism gives people hooks to hang them on. These are companies they’ve heard of. So now they learn about forced arbitration and why it’s bad or why it’s associated with sexual harassment or racial discrimination. And they say, ‘Oh, I don’t want that in my contract. And hey look, Nia’s working on that.’ Diverse reporting is probably easier to understand, especially for women who want to be counted. So those types of things become more tangible. And then the other thing that’s going to help us be successful is the wealth transfer. Have you been watching that?

BR: Yeah, there was a recent article I read about the huge generational wealth transfer that’s about to take place.

KH: Yeah—so basically, either through inheritance and/or women earning their own wealth, there’s trillions of dollars transferring to women and they’re going to be making investment decisions, and the investment industry is going to have to change. It cannot stay in the status quo, where we don’t have women in leadership.

As investors, we’re just not trained to be conscious of who manages our mutual funds, who’s choosing the companies—it’s not something that’s on our radar. So we’re trying to enable women and all investors to own what they own. And that means really knowing what they own; then they can direct their money towards the solutions and the things that they care about, that they know will be good for their communities.

BR: Do you see that number ticking up or are we still facing strong headwinds?

KH: The status quo is strong! And yet with the current wealth transfer underway, we are seeing more women and younger people in charge of investment decisions—and with that wave, we are ready to see these numbers change. Our economy and our planet need a more diverse set of decision makers when it comes to deciding which companies get capital, and get included in investment portfolios and which do not.

BR: And how do you see the next five to ten years in this sector, in responsible investing?

KH: It’s growing. It’s growing despite what you read or hear about the ESG backlash, and of course the DEI mess. We get the economy and the world that we invest into. So by shifting our investments, we can make a huge difference. It’s kind of silly, but like they did in that movie [‘Back to the Future’], things you do in the past impact the future. What I want us to do is take that metaphor and say, if we change our investments right now, the world is going to be different. It’s going to be more and more important that we really understand the connection. I say this all the time, and it seems obvious, and yet it’s still so tangential in our society.

If women said, ‘we are only investing in portfolios led by women,’ that would change the economy immediately. If Melinda Gates said to her investment advisor, ‘I will only invest in companies that have women in leadership,’ the entire economy would change. Obviously, if Melinda Gates does it, it’s a big change, but it also sends a signal to everybody else.

We’ve got the young people not wanting to vote for Biden because of Gaza. That’s a wake-up message to a lot of us: they’re already coming to us mainly because of the environment but then also the racial justice issues they care about. The industry is not ready for them. It’s gonna be a tidal wave.

BR: You know, between Melinda and Mackenzie… if they just decided to do exactly what you just said, that would create a tsunami.

KH: Oh, absolutely. I’ve heard Melinda say this on stage—I don’t remember the exact statistics but basically, when she graduated from computer science, women were about 30% of computer science grads, and now it’s gone down. I think she said it was 17% or 18%. For me, the answer is, if you want women trained in computer science, then have every single one of the investments that you own in companies that have computer science training programs for women. There you go. Done DONE! Melinda can literally change exactly what she wants to do. She just has to put the investment out there. Women [like her] hold so much power.

BR: What would you say to all the generations of young women now starting their careers in this space?

KH: I would say to bring their full selves, and that their analysis matters. Our whole economy is resting on this “modern” portfolio theory, this school of thought that came out of the University of Chicago in the 50’s and 60’s. Maybe it was modern at the time; it’s definitely not modern now. It didn’t take into consideration that we live on an Earth with finite resources. Those white men sitting at that table believed that we live on an earth with infinite resources, and that returns could be infinite; and our entire capitalist economic theory is written based on principles that were never true. And women knew that then—that’s the totally bizarre piece of it.

So bringing what you know and questioning the status quo is going to be our best bet. We’re living in a house of cards, and it’s going to require taking some of these nature-based solutions and bringing them into our economy.

BR: For someone who’s fairly new to investing, how can they start with you?

KH: We specialize in public equities and just about everybody has room for public equities in their portfolio. If someone already works with a financial adviser, we offer separately managed accounts that they can get through their financial adviser so they don’t have to come directly to us.

Going to our website is a great start. It’s a new site and we’re still working on putting up more of our webinars and our educational materials, And if there are any questions, we are just an email away.

Read about another woman powerhouse, this time in the professional football arena (yes, really!)